Take advantage of real time requests for foreign exchange fx rates with our rate calculator and know how much foreign currency fx you re sending before you set up the payment online wires sent to a bank outside the u s.

Chase sapphire exchange rate euro.

You can also get the.

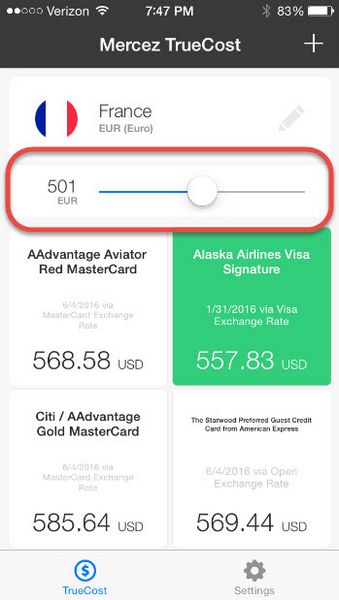

If you play with these two tools long enough you ll start to notice a pattern.

Below are the rates we found as of nov.

The average card exchange rate is therefore 1 1165.

Credit cards mortgages commercial banking auto loans investing retirement planning checking and business banking.

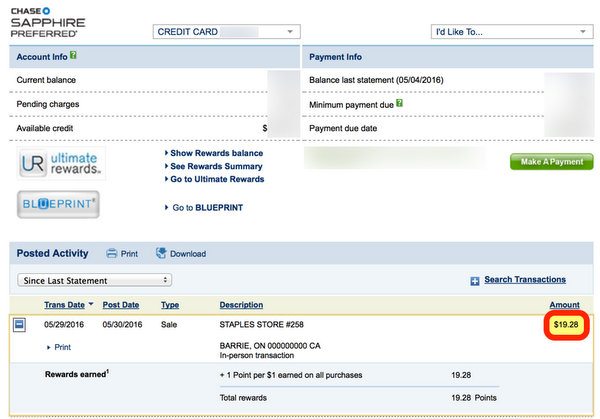

57 84 using the chase sapphire preferred 1 1 2967 canadian dollars 57 42 using the citi prestige 1 1 3061 canadian dollars.

If you plan on converting large sums chase has around 10 note rate.

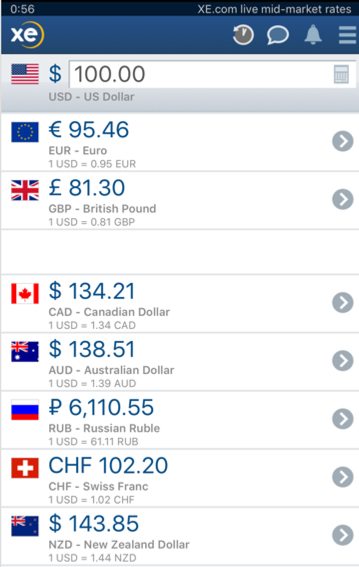

The visa exchange rate is 1 1159 and the mastercard exchange rate is 1 1170 as of may 7 2019.

You can exchange foreign currency in chase through a bank teller.

Both cards earn 2x points on dining.

In foreign currency fx have no chase wire fee for amounts equal to 5 000 usd or more or only a 5 chase wire fee when.

Chase bank international money transfers to or from the usa have higher transaction charges due to a less competitive exchange rate offered by chase bank.

28 2018 for exchanging dollars into popular foreign currencies with the top credit card issuers along with exchange company travelex.

Also bank tellers often are not knowledgeable of the current or real rate spread and hidden fees so do not be surprised.

Usa money transfer specialists typically sending funds to or from your chase bank account in us dollars or uk pounds will involve a margin rate of 4 0 much higher than most.

The credit card and debit card exchange rates reflect this average as visa and mastercard are the most widely accepted card networks internationally.

Chase sapphire preferred points are worth 0 0125 each.

Visa offers its exchange rate calculator while mastercard makes its mastercard currency conversion tool available online.

And you re deciding between using your chase sapphire preferred visa or citi prestige mastercard.

Mastercard usually has a small though occasionally quite significant advantage when it comes to foreign exchange rates.

But if you want the real mid market rate itself another option is coming.

Their rates are always better when you compare them with currency exchange companies such as travelex either online or at the airport.

When you use a chase sapphire preferred or reserve credit card abroad your money will likely be converted at an exchange rate set by visa the card issuer.

While currency conversion performed by your card network is generally fair you should never opt in for dynamic currency conversion.